The purpose of this document is to introduce implied, local and stochastic volatility, to review evidence of non-constant volatility, and to consider the implications for option pricing of alternative random or stochastic volatility models. We focus on continuous time diffusion models for the volatility, but we also briefly discuss certain classes of discrete time models, such as ARV or ARCH.

By Prof. Klaus Erich Schmitz Abe http://www.maths.ox.ac.uk/~schmitz/

Download Matlab version: Local_vs_Dupire.m

Download Excel version: Local_vs_Dupire.xls

Download Matlab version: vol_test.m

Summary:

•Implied Volatility - Ito's Lemma

•Applying Ito to the Hedging Portfolio

•Risk-Neutralization and No-Arbitrage

•Implied Volatility (Smiles and Skews)

•Coupled SDEs for Stochastic Volatility

•Risk-Neutralization and No-Arbitrage

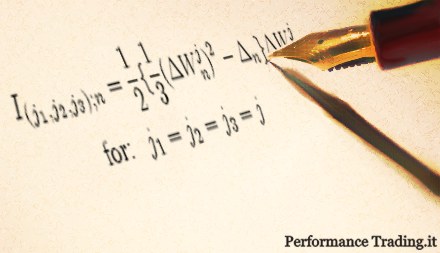

•Exact Solution for Heston Volatility